The Texas Department of Insurance (“TDI”) adopted new administrative rules for reciprocal reinsurers that took effect on January 1, 2022. According to TDI, the goal of the new reinsurance regulations is to “ensure TDI retains its authority to regulate credit for reinsurance matters associated with covered agreements, align TDI’s rules with the current approach to regulate reserve financing arrangements for certain life insurance policies, and align TDI’s rules with updates to the National Association of Insurance Commissioners’ (NAIC) accreditation requirements.”

Read More New Texas Reinsurance Rules for Reciprocal Insurers Take Effect

Locke Lord QuickStudy: What Goes Around Comes Around

In 1990, the Second Circuit in Bellefonte Reinsurance Co. v. Aetna Casualty & Surety Co., 903 F.2d 910 (2d Cir. 1990), affirmed a District Court judgment that reinsurers were not obligated to pay additional sums for defense costs over and above the limits of liability specified in a facultative reinsurance certificate. Since then, the Bellefonte rule acted as a de facto cap for both indemnity and expense under a facultative certificate. This issue of ‘limits’ had been hotly contested, and Bellefonte seemed to put it to rest. …

Read More Locke Lord QuickStudy: What Goes Around Comes Around

NY DFS Releases Guidance on Multi-Factor Authentication

On December 7, 2021, the New York Department of Financial Services (“NY DFS”) released an industry letter providing guidance on Multi-Factor Authentication (“MFA”). MFA, which requires users of information systems to provide an additional “factor,” often through a one-time code or push notification to their mobile device, in addition to their password when accessing information systems.

Read More NY DFS Releases Guidance on Multi-Factor Authentication

Locke Lord Team Represented Convex in Obtaining Reciprocal Reinsurer Status

A Locke Lord team led by Zachary Lerner (New York) assisted Convex Insurance UK Limited (CIL) and Convex Re Limited (CRL) in obtaining reciprocal reinsurer status, the first alien insurers to receive such designations in the United States.

Read More Locke Lord Team Represented Convex in Obtaining Reciprocal Reinsurer Status

Federal Insurance Office Releases Responses to Request for Information on the Insurance Sector and Climate-Related Financial Risks

In a September 1 InsureReinsure Blog post, I discussed the Federal Insurance Office Request for Information on the Insurance Sector and Climate-Related Financial Risks. Responses to the request were due to the FIO on or before November 15, 2021.

Read More Federal Insurance Office Releases Responses to Request for Information on the Insurance Sector and Climate-Related Financial Risks

10 Things to Consider When Buying, Selling or Operating a Reinsurance Intermediary

The global reinsurance landscape is an interconnected, intertwined marketplace that continues to grow and evolve. As insurance companies, agencies, program administrators and other industry actors continue to expand their creative horizons and develop innovative insurance products, the need for reinsurance coverage has accelerated as well.

Read More 10 Things to Consider When Buying, Selling or Operating a Reinsurance Intermediary

Insurers in the Mix at COP 26 in Glasgow, Scotland

In addition to the discussion of the future of the energy sector at the 26th United Nations Climate Change Conference of the Parties (”COP26”) taking place in Glasgow, Scotland from October 31 – November 12, 2021, there has also been a discussion of the role of the insurance industry in addressing climate change.

Read More Insurers in the Mix at COP 26 in Glasgow, Scotland

The Reintroduction of PRIA Stirs Skepticism Among Several Trade Groups

U.S. Representative Carolyn Maloney’s reintroduction of the Pandemic Risk Insurance Act (“PRIA”), which would create a shared public-private insurance program styled after the Terrorism Risk Insurance Act, has stirred skepticism among several trade groups. …

Read More The Reintroduction of PRIA Stirs Skepticism Among Several Trade Groups

Rep. Carolyn Maloney Reintroduces the Pandemic Risk Insurance Act

On November 2, 2021, New York Congresswoman Carolyn Maloney reintroduced the Pandemic Risk Insurance Act (“PRIA”) in the U.S. House of Representatives. PRIA would create the Pandemic Risk Reinsurance Program (the “Program”), a shared public-private system that would require insurers to offer coverage in all commercial property and casualty lines of insurance for insured losses resulting from public health emergencies or future pandemics.

Read More Rep. Carolyn Maloney Reintroduces the Pandemic Risk Insurance Act

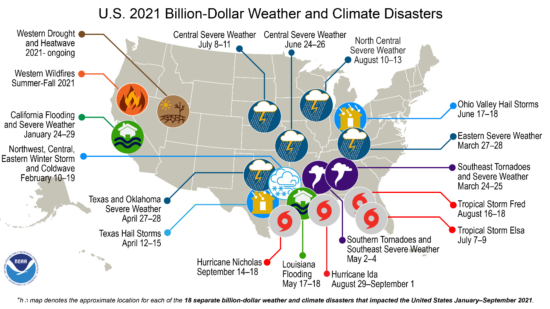

The United States Hit With 18 Separate Billion-Dollar Disasters So Far in 2021, a New Record

On October 8, 2021, the National Oceanic and Atmospheric Administration (“NOAA”) announced that the number of billion-dollar plus disasters so far in 2021 had achieved a new record high of 18 as of the end of September, putting 2021 on a pace to exceed the record number of billion-dollar plus disasters set in 2020.

Read More The United States Hit With 18 Separate Billion-Dollar Disasters So Far in 2021, a New Record